Article

Top 8 SOX Compliance Software Tools for Audit-Ready Teams

Mike Reeves, PhD

|

Updated on

Feb 10, 2026

|

Created on

Dec 5, 2025

SOX compliance creates constant pressure for finance, IT, and compliance teams. Everyone deals with strict regulatory requirements, tight timelines, and heavy documentation work.

The Sarbanes-Oxley Act (SOX) protects investors and keeps financial reporting accurate, but the daily effort behind it drains teams that still rely on spreadsheets, email threads, and manual effort to keep up. Leading organizations are now switching to modern audit software to centralize these workflows.

The pace feels demanding when you manage controls, evidence, and reviews across different systems. Each step depends on clean data and clear ownership, yet manual work makes the process slower and easier to derail. Small delays stack up and create more stress as audits get closer.

In this article, you’ll find the tools and processes that help teams stay organized, reduce friction, and manage SOX requirements with more confidence.

What Is SOX Compliance Software?

SOX compliance software is a tool that helps teams handle SOX compliance requirements without constant manual effort.

It supports the work that finance and compliance teams handle for SOX, especially around internal controls, accurate financial reporting, and consistent compliance tasks.

Teams use it to manage controls, review evidence, and stay in sync across each quarter. Instead of jumping between folders or spreadsheets, the software keeps everything inside a single platform.

That gives control owners one place to handle control assessments, risk assessments, and documentation for auditors.

A strong SOX compliance platform helps teams:

Keep a clean view of control tests and test status

Track progress across controls, evidence, and deadlines

Support internal audits and external auditors with clear audit trails

Spot control gaps early and maintain compliance across cycles

Protect financial data and reduce risk inside daily financial systems

It also supports SOX compliance management for publicly traded companies that need reliable control mapping, accurate financial records, and a structured risk and control matrix.

Teams that want to manage compliance with less stress rely on SOX software to stay organized, handle compliance reporting, and support a consistent compliance process all year.

SOX Compliance Requirements

SOX took shape after major accounting scandals shook investor confidence and exposed weak internal controls.

Companies like Enron, Tyco, and WorldCom hid problems inside complex financial operations, which led to billions in losses. SOX created structure, accountability, and strict rules that every publicly traded company and many accounting firms must follow.

Below are the core sections that guide daily SOX compliance efforts. At Vero AI, our mission is to simplify these regulatory compliance challenges through expert-led technology:

Section 302: Corporate Responsibility for Financial Reports

Section 302 centers on corporate responsibility at the highest level. CEOs and CFOs must personally certify that financial statements remain accurate and complete. Leadership also takes responsibility for every internal control that protects those financial reports.

Teams handle clear documentation, safeguard data integrity, and keep a clean path for each certification. Strong internal controls management supports reliable reporting and helps prevent corporate fraud.

Section 404: Management Assessment of Internal Controls

Section 404 focuses on the structure and strength of internal control. Management and external auditors must review and confirm that controls work as documented. These reviews add pressure because teams must show accurate testing, proof of operation, and clear support for every control.

Many leaders call Section 404 the hardest part of SOX due to the volume of control tests. Organized risk assessments, structured testing workflows, and timely fixes help reduce control failures and compliance gaps.

Section 409: Real-Time Issuer Disclosures

Section 409 makes sure investors receive fast updates when a company’s financial condition shifts. Teams must report any material change as quickly as possible. Timely updates help maintain trust and reduce risks around outdated information.

Clear visibility across financial transactions supports accurate reports. Strong controls also help teams maintain compliance status and protect investor confidence.

Section 802: Criminal Penalties for Altering Documents

Section 802 sets strict criminal penalties for altering, hiding, or destroying business records. Penalties can reach up to 20 years in prison for anyone who interferes with investigations. The rules apply to paper records, electronic files, emails, and other forms of corporate documentation.

Teams manage sensitive data with care, keep clean audit trails, and protect financial records within structured review cycles. Regular internal audits help teams stay ready for any investigation.

Section 906: Corporate Responsibility for Financial Reports

Section 906 adds another layer of accountability for executives who certify financial statements. Leaders face fines of up to five million dollars and up to 20 years in prison if reports contain false or misleading information.

The goal is to promote honesty, accuracy, and clear oversight across reporting cycles.

Reliable documentation, accurate financial statements, and consistent controls support strong audit readiness. Teams reinforce compliance posture through structured workflows that help them proactively manage risk.

8 Best SOX Compliance Software Options in 2025

Teams often search for tools that cut down repetitive work and keep all control in one place. SOX platforms give structure, visibility, and better checks across each cycle.

Below are the options that help teams handle daily tasks with less pressure:

1. Vero AI

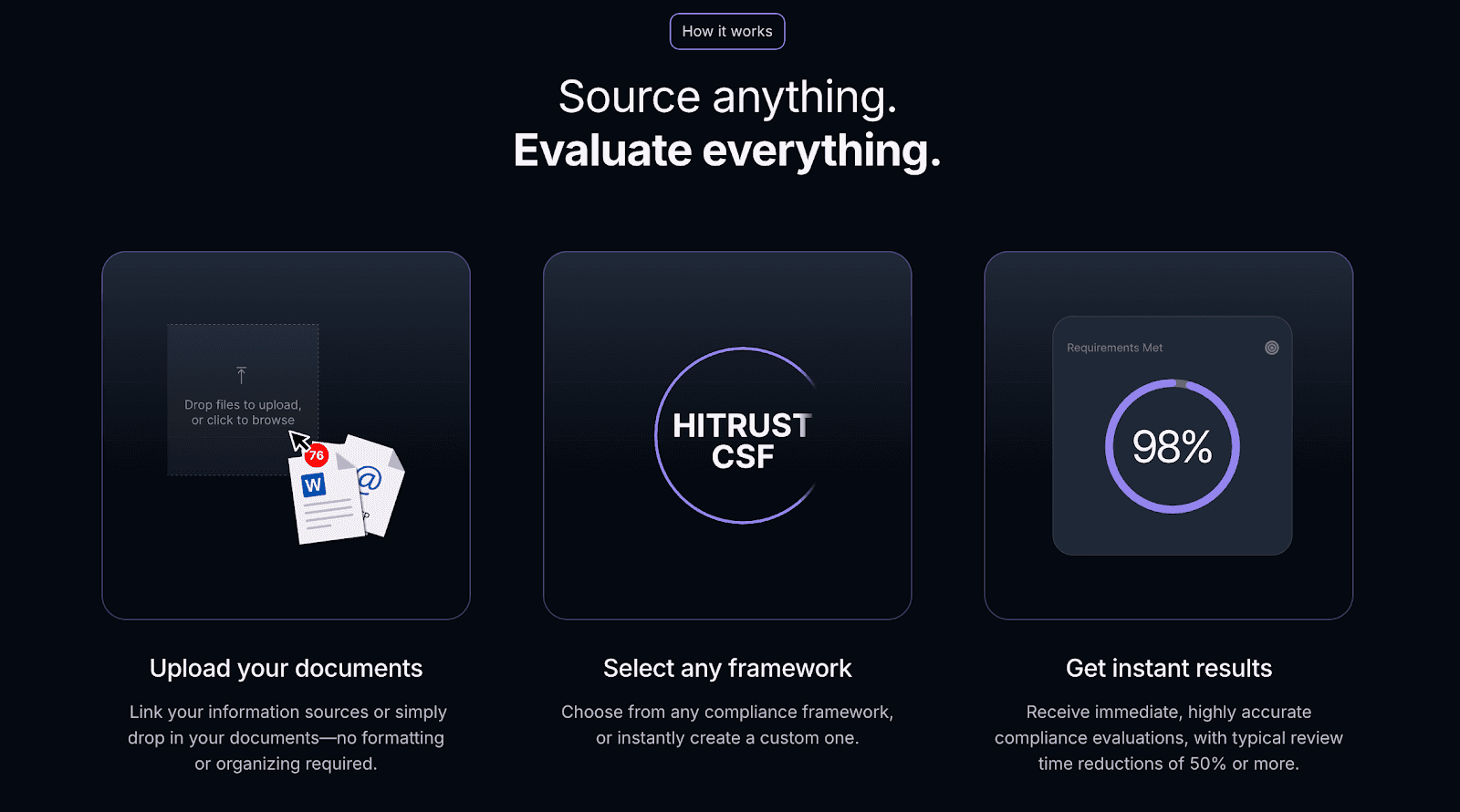

Vero AI gives SOX teams a faster way to review controls, evidence, and findings. The platform reads huge document sets and scores each control against SOX and other frameworks.

Many firms report up to 50% lower review time on complex work. Reviewers keep pace with quarterly testing cycles and year-end reporting without feeling buried in manual checks.

Teams upload evidence, pick a framework, and run structured tests inside one secure workspace. Vero AI handles PDFs, spreadsheets, exports, and portal downloads without extra prep.

The engine scores each item, explains every result, and links findings back to the original source. Teams reduce human error through consistent scoring and clear, traceable logic that supports every SOX conclusion.

SOX reviewers use Vero AI to keep Section 302 and 404 work under control. The platform maps evidence to controls, highlights weak areas, and builds clear narratives for each test.

Teams handle SOX compliance software tasks across hundreds of controls without losing sight of the risk and control matrix or key internal controls.

Key Features

Automated compliance audits - Runs structured checks against SOX and other frameworks, which reduces manual review time.

Rapid evidence assessment - Filters out irrelevant files, flags gaps, and cuts the back-and-forths with clients.

Multi-framework support - Handles SOX, SOC 2, ISO 27001, NYDFS 500, PCI DSS, and custom standards in one place.

Control level scoring - Assigns a clear score to each control, with traceable logic that auditors can follow.

Standard specific reports - Generates summaries that match SOX expectations and support clean, defensible audit trails.

Seven purpose-built AI agents for compliance automation - These dedicated agents handle controls, policies, and questionnaires to significantly reduce manual testing cycles.

Secure, audited infrastructure - Runs on a SOC 2-aligned stack with strong access controls and logged activity.

Beyond compliance insights - Surfaces trends in control failures and evidence quality to help teams improve future cycles.

Vero AI fits teams that handle heavy SOX workloads and want reliable, repeatable audit management. Firms use it to cut noise in documentation, reduce manual effort, and keep every engagement ready for scrutiny.

Ready to see how Vero AI can save 100+ audit hours on your next SOX review? Request a demo today!

2. AuditBoard

AuditBoard is a connected risk and audit platform that brings risks, controls, issues, and policies into one workspace. Teams use modules like SOXHUB and OpsAudit to manage internal control duties, track evidence, and support reporting processes across each SOX cycle.

Source: auditboard.com

Large organizations rely on it as part of broader enterprise compliance solutions that support risk management, financial disclosures, and central oversight across complex audit environments.

The platform gives compliance professionals a structured way to run tests, organize documentation, and move tasks through automated workflows.

Evidence tracking, control libraries, and integrations help teams coordinate each audit process while supporting data security, security controls, and risk mitigation across operational risks.

However, some users mention higher costs, complex onboarding, and limited visibility across prior year risk assessments when they compare inputs or focus on the most critical risks.

Key Features

Connected risk platform - Links risks, controls, issues, and frameworks in one place.

SOX-specific modules - Supports SOX programs through SOXHUB and related applications.

Workflow and task management - Tracks testing steps and sign-offs.

Evidence and prepared-by-client (PBC) tracking - Centralizes requests and responses for audits.

Integration options - Connects with Microsoft Office and BI tools for extended reporting.

3. Workiva

Workiva is a cloud-based reporting and compliance workspace that connects financial data, documents, and teams in one location.

Source: workiva.com

Many organizations use it to manage financial disclosures, automate parts of their SOX compliance program, and support coordination between finance, legal, and risk or audit management teams.

It also centralizes documents and linked data, so updates carry across reports without repeated edits.

The platform helps teams manage process flows, PBC requests, control testing, and real-time reporting with more structure. It also fits into a centralized compliance framework for groups that want consistency across audits and filings.

Even though Workiva is widely adopted, users mention higher pricing, slower editing during peak periods, and limited features unless they upgrade to additional modules.

Key Features

Connected reporting workspace - Central place for financial, environmental, social, and governance (ESG), and regulatory documents.

Linked data and documents - Shares one source of numbers across multiple reports and notes.

SOX and controls support - Tracks testing status, PBCs, and control evidence.

Collaboration and audit trails - Captures comments, sign-offs, and version history.

Data connections - Syncs data from source systems and spreadsheets.

4. FloQast

FloQast is accounting-focused management software used by teams that want a clearer way to run month-end close tasks, reconciliations, and documentation in one place.

Source: floqast.com

Many finance teams use standardized checklists to keep workflows consistent. Some also link FloQast checklists and reconciliations to SOX control testing so key evidence stays ready for auditors.

It helps teams follow organized steps that make financial reviews easier to track during audits, which aligns well with organizations that also use compliance audit software in other parts of the business.

Teams often adopt FloQast to centralize reconciliations, close tasks, and support files. It gives leaders better visibility into progress and helps staff reduce manual tracking that normally lives across spreadsheets or email threads.

While it brings strong structure for daily and monthly close work, some users note slower performance during peak activity and extra setup effort when they tailor it to complex environments.

Key Features

Close management - Centralizes checklists, tasks, and reviewer steps.

Reconciliation tools - Supports account reconciliations and matching.

Task tracking - Highlights progress and ownership across teams.

Audit trail - Keeps documentation structured for review.

Integrations - Connects with Excel, Google Sheets, and other accounting systems.

5. Onspring

Onspring is a no-code governance, risk, and compliance (GRC) platform that helps teams design workflows for risk, audit, policy, and compliance processes in one place.

Source: onspring.com

Teams use it to design custom applications, track issues, and link risks, controls, and assessments without writing code. It fits SOX and internal audit programs that need more structure around requests, follow-ups, and department-wide reporting.

It doesn’t include built-in SOX control content, so teams import their own control libraries or rely on external frameworks like the United Compliance Framework (UCF) to support SOX work.

Onspring’s flexibility lets admins create custom fields, forms, and relationships on a single data set. Dashboards and reports help leaders track open issues and upcoming work.

Even though the platform offers strong flexibility, users often mention a learning curve, limits on some fields, and extra effort to fine-tune reports or layouts before everything matches internal needs.

Key Features

No code configuration - Let teams build forms, fields, and workflows without developers.

GRC modules - Covers risk, audit, compliance, policy, vendor, and incident use cases.

Workflow automation - Routes tasks, reminders, and approvals through one system.

Dashboards and reporting - Surfaces status, exposure, and outstanding items.

Integrations - Connects with tools like ServiceNow and Slack for intake and updates.

6. Sprinto

Sprinto focuses on security compliance automation for cloud-native and SaaS companies. Teams connect cloud accounts, identity providers, and SaaS tools, then track readiness for frameworks such as SOC 2, ISO 27001, GDPR, HIPAA, and PCI DSS in one dashboard.

Source: sprinto.com

Some companies also use Sprinto alongside their SOX compliance software to monitor IT and security controls that fall under their SOX scope, including access controls and change management. This helps support key IT general controls (ITGC) areas without manual tracking.

The platform centers on continuous control monitoring and automated evidence collection, giving smaller teams a structured way to stay audit-ready. Security and compliance leads use Sprinto to keep tasks, policies, and tests connected across their programs.

However, reviewers note limited developer tool integrations, occasional UI bugs, and onboarding challenges for teams new to compliance.

Key Features

Security compliance automation - Manages SOC 2, ISO 27001, GDPR, HIPAA, PCI DSS, and more.

Continuous control monitoring - Tracks cloud and SaaS systems for drift and gaps.

Automated evidence collection - Pulls logs, configurations, and proof for audits.

Task and workflow tracking - Assigns owners, due dates, and remediation steps.

Trust center and questionnaires - Shares posture and handles customer security reviews.

7. Vanta

Vanta focuses on security and compliance automation for cloud-based and SaaS companies that need to stay audit-ready across frameworks such as SOC 2, ISO 27001, HIPAA, and PCI.

Source: vanta.com

Teams that manage SOX alongside SOC 2 often use Vanta to monitor IT and access controls within their SOX scope.

It also connects cloud providers, identity tools, devices, and SaaS apps, then uses a central dashboard to show control status, open tasks, and upcoming audit work.

The platform brings policies, assets, and evidence into one place so small compliance teams can keep a clear view of their security posture.

Even though reviewers highlight strong automation and integrations, they also mention higher pricing for small teams, gaps with some niche vendors, limited advanced features on lower tiers, and a learning curve for new users.

Key Features

Automated control monitoring - Tracks devices, cloud services, and identity tools against policy.

Evidence collection - Gathers proof for SOC 2, ISO 27001, HIPAA, and other audits.

Policy and training content - Offers standard policies and security awareness modules.

Integrations and alerts - Connects to common SaaS tools and sends tasks and reminders.

Trust center and vendor risk - Shares security posture and helps review third-party vendors.

8. Archer

Used by large organizations that need structured governance and audit oversight, Archer supports SOX programs by connecting risks, controls, issues, and documentation in one place.

Source: archerirm.com

Many teams rely on it to manage SOX 404 testing workflows, remediation tasks, and reporting activities tied to financial reporting risk. The platform also helps groups coordinate risk assessments and track internal controls across business units with more structure.

Companies often adopt Archer when they want a system that covers broader GRC needs beyond SOX, including operational risk, policy management, and vendor oversight.

Reviewers highlight the depth of configuration options and the value of dashboards for seeing audit progress and control status.

However, some users mention a heavier administrative load, a learning curve during setup, and limits in reporting flexibility when teams customize the platform for complex environments.

Key Features

Risk and compliance workspace - Brings risks, controls, and assessments into one system.

SOX and audit lifecycle support - Tracks SOX 404 work, findings, and remediation.

Workflow automation - Routes approvals, reviews, and documentation steps.

Dashboards and reporting - Shows review status and risk exposure across teams.

Access and configuration options - Supports role-based access and custom data models.

Why Teams Use SOX Compliance Software

SOX work moves fast, and every control owner handles tight timelines, heavy documentation, and constant follow-ups. Teams use SOX compliance software because it keeps everything organized in one place and removes the messy steps that slow audits down.

The right system helps teams track controls, store evidence, and follow clear tasks during quarterly testing and year-end reporting.

Everyone sees what needs attention, what’s overdue, and what auditors will review next. This structure cuts manual effort and reduces the risk of missing key details during walkthroughs or testing.

Teams also rely on these platforms to keep documentation accurate across control owners, reviewers, and leadership. With organized workflows, version control, and clear ownership, SOX programs stay on track even when deadlines get tight.

SOX software gives teams a clearer view of risks, gaps, and responsibilities, which helps them stay ready for every audit with less stress.

Even with strong software, companies must still maintain proper controls, data accuracy, and review processes because no tool alone can achieve full SOX compliance.

Why SOX Compliance Software Needs to Go Beyond Evidence Storage

Most SOX compliance platforms help teams collect evidence and manage attestations but stop short of actually interpreting whether that evidence satisfies each control requirement. That judgment layer still falls to human reviewers, consuming hundreds of hours per audit cycle.

Vero AI automates that step. By combining advanced AI with encoded auditor expertise, the platform evaluates your financial controls documentation against SOX requirements, delivers objective compliance scores, and generates fully traceable, audit-ready reports explaining what passes, what fails, and why.

For finance and internal audit teams conducting multiple compliance reviews annually, this translates to 50%+ reductions in audit review time and 100+ hours saved per engagement.

Related reading:

Automated Compliance Software: What AI-Native Platforms Actually Automate

Financial Audit Software: How AI Transforms the Evidence Review Process

Enterprise Compliance Solutions: Managing Multi-Framework Programs at Scale

Cut SOX Review Time in Half With Vero AI!

SOX work doesn’t have to feel overwhelming. With the right structure, clear ownership, and tools that cut unnecessary steps, teams stay organized and move through each cycle with more confidence.

Modern platforms take the pressure off by keeping controls, evidence, and reviews in one place, which gives teams the space to focus on accuracy instead of chasing files.

If you want deeper visibility, cleaner documentation, and faster review cycles, Vero AI brings all of that into a single workspace. It reads documents, scores controls, and highlights gaps with clarity that helps teams stay ahead of deadlines and reduce repeat work.

Ready to see how Vero AI supports smoother SOX cycles? Book a demo today!

SOX Compliance Software FAQs

Table of Contents

Mike Reeves, PhD

Mike is a key figure at the intersection of psychology and technology. He has created and managed algorithms and decision-making tools used by more than half of the Fortune 100.