Article

6 Best Enterprise Compliance Solutions for Audit-Ready Teams

Eric Sydell, PhD

|

Updated on

Feb 10, 2026

|

Created on

Nov 6, 2025

Keeping up with compliance can feel like a never-ending race. New regulations appear faster than teams can track them, and every department uses its own system to stay on top of requirements. The result? Duplicated work, missing records, and endless review cycles that eat into valuable time.

For large organizations, the challenge grows even bigger. Teams manage hundreds of policies, track controls across multiple systems, and handle constant changes from regulators. It’s easy for important details to get overlooked.

Modern compliance platforms simplify that process. They bring all data together in one place and give leaders a clear view of every framework, policy, and task. With everything connected, teams can stay organized, make confident decisions, and be ready for every audit.

In this article, you'll find the top enterprise audit software solutions that help companies manage complex frameworks, automate evidence collection, and stay audit-ready with less manual work.

What Are Enterprise Compliance Solutions?

Enterprise compliance solutions are platforms that help companies manage compliance programs, risks, and regulatory requirements in one place. They bring structure to a process that’s often scattered across tools, teams, and frameworks.

If you handle compliance management, you already know how messy it gets. Every department tracks policies differently. Each update needs attention. It’s easy to lose visibility once multiple business units get involved.

These solutions give you one view of everything. You can track controls, document procedures, and spot compliance risks before they grow. Manual processes turn into automated workflows that save time and reduce errors.

For compliance officers and leaders in the financial services industry, this visibility is everything. Enterprise compliance risk management isn’t just about oversight anymore. It’s about proactive risk management, real-time insights, and a steady compliance strategy that keeps teams aligned across the organization.

What to Look For in an Enterprise Compliance Solution

Every organization handles compliance differently, but the right platform keeps everything connected. It helps teams meet compliance requirements without chasing documents or repeating manual steps.

Look for a solution that integrates with existing systems and supports how your company operates. A strong platform should help compliance professionals and chief compliance officers assess risk exposure, track results, and manage audits across multiple departments.

Modern solutions include automation tools that cut repetitive work. They capture data, trigger alerts, and prepare reports for branch audits and risk assessments. Financial institutions, broker dealers, and investment advisers depend on these capabilities to comply with frameworks like PCI DSS and protect data privacy.

A complete system should also identify areas for improvement and strengthen regulatory compliance through training resources and clear visibility. That holistic approach supports better decision making, confident operations, and consistency across teams.

The best solutions enable businesses to adapt quickly, manage potential threats, and maintain control through technology that supports their full lifecycle of compliance.

Top 6 Enterprise Compliance Solutions in 2025

Below are the leading enterprise compliance solutions trusted by teams across industries:

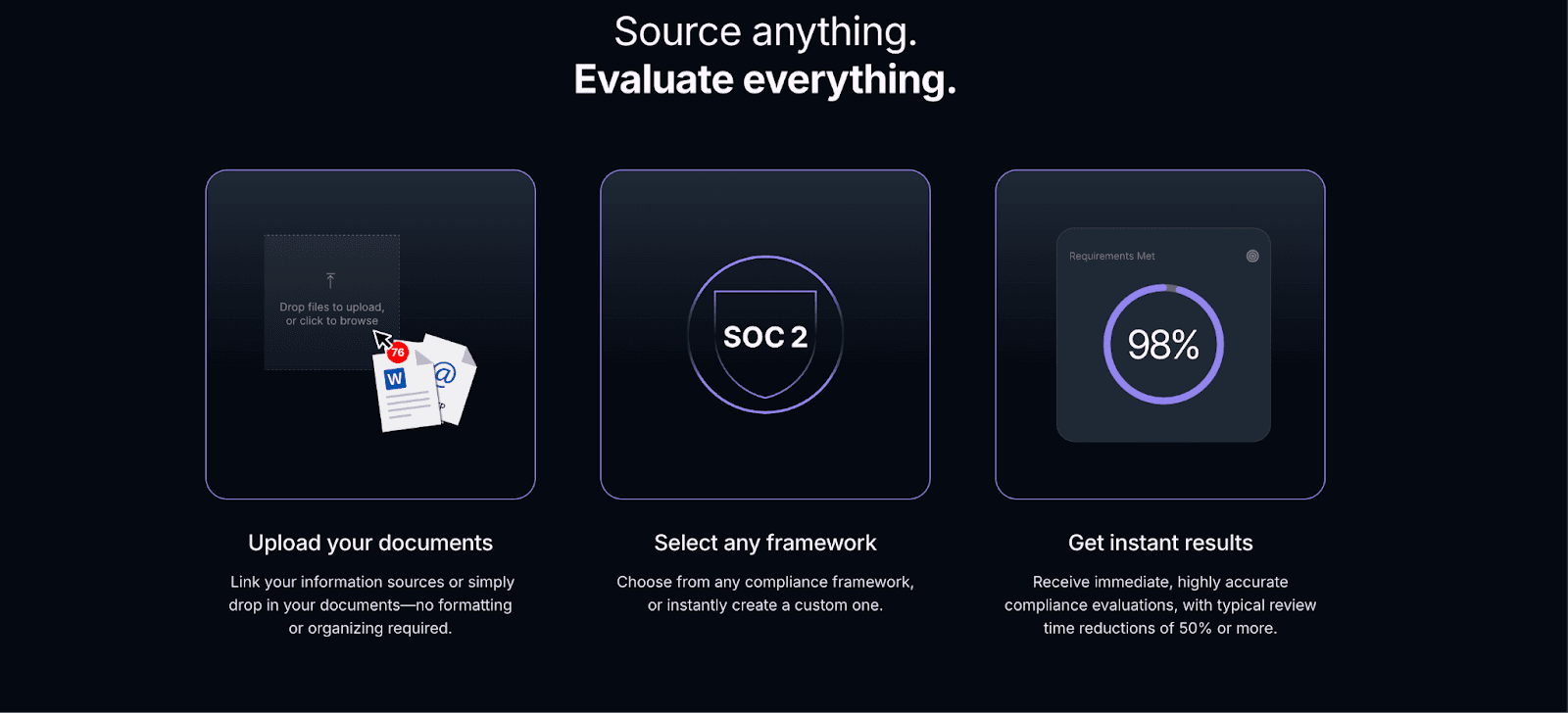

1. Vero AI

Vero AI turns complex audits into clear, actionable results. The platform helps enterprises evaluate compliance documentation at scale, cutting review time by 50% or more.

Instead of spending weeks checking evidence manually, compliance teams can upload documents, select any framework, and receive precise, audit-ready results in minutes.

The platform’s system combines automation with human expertise, which creates accurate outcomes across every compliance standard.

For large enterprises, Vero AI replaces disjointed systems with a single, connected platform that manages frameworks, reports, and risk assessments in one place.

It supports all compliance frameworks, including SOC 2, ISO 27001, GDPR, HIPAA, and PCI DSS, helping organizations maintain control while adapting to changing regulations.

Its specialized AI agents for compliance automation, each built for a specific audit function, handle everything from policy drafting to vendor risk analysis.

Backed by experts with decades of enterprise and regulatory experience, Vero AI simplifies compliance for teams across industries.

The platform helps compliance officers, auditors, and business leaders gain clarity on risk and efficiency in decision-making. It turns compliance from a manual task into a measurable business advantage.

Key Features

Automated compliance audits – Cut audit review time by up to 80% across multiple frameworks with precise, automated evaluations.

AI evaluation agents – Handle policies, third-party risk, procurement, questionnaires, ROI, and custom use cases through purpose-built automation.

Multi-framework support – Manage existing and future standards, including regulatory and corporate policies, in one centralized platform.

Rapid evidence assessment – Identify relevant data quickly and reduce back-and-forth between auditors and clients.

Standard-specific reports – Generate tailored summaries formatted for each compliance framework automatically.

Secure infrastructure – Maintain compliance with SOC 2 and ISO 27001 standards using encryption and restricted access controls.

Beyond compliance analytics – Reveal inefficiencies, track improvement opportunities, and enhance compliance visibility across teams.

Continuous updates – Adapt instantly to compliance changes and integrate new frameworks without manual rework.

Vero AI offers clarity, speed, and confidence to every compliance team. Enterprises using Vero AI save hundreds of hours per engagement while improving audit accuracy and consistency.

Ready to cut audit time in half? Request a demo today.

2. ServiceNow GRC

ServiceNow GRC brings governance, risk, and compliance together in one platform designed for enterprise operations.

Source: servicenow.com

The system connects daily business activities to compliance goals, helping teams detect issues early and maintain regulatory alignment. It integrates with other ServiceNow modules, creating consistent workflows across IT, risk, and audit functions.

Large organizations use ServiceNow GRC to manage policies, assess risks, and streamline audits across departments. Its dashboard offers a real-time view of controls, incidents, and status updates, giving compliance leaders a clearer sense of accountability.

Automated workflows also support faster responses to compliance changes and reduce the need for manual coordination between teams.

Key Features

Centralized dashboard – Combine risk, compliance, and audit data in one view.

Automated workflows – Simplify task assignments and approvals across departments.

Real-time monitoring – Track compliance activity and incident resolution continuously.

Policy management – Maintain up-to-date documentation and track policy adoption.

Risk assessment tools – Identify, assess, and prioritize high-impact risks efficiently.

3. MetricStream

MetricStream helps enterprises manage compliance, audit, and risk activities within a unified framework. It supports organizations handling complex regulatory environments, including financial services firms and large multinational corporations.

Source: metricstream.com

Compliance officers and teams gain a structured view of policies, controls, and assessments, making it easier to stay aware of ongoing compliance requirements and improve internal practices.

It’s recognized by compliance professionals for governance capabilities and scalability. The platform also includes industry-specific templates that help organizations maintain consistent standards and improve how employees track and report compliance data.

This flexibility allows global companies to manage audits across multiple jurisdictions and frameworks efficiently.

Key Features

Unified compliance management – Centralize audits, risk, and policy tracking in one system.

Predefined templates – Use ready-made frameworks for industry-specific regulations.

Advanced reporting tools – Generate visual reports for audits and board reviews.

Policy and control mapping – Link internal practices with global regulatory requirements.

Workflow automation – Assign, monitor, and review compliance tasks with clear accountability.

4. IBM OpenPages

IBM OpenPages offers a flexible governance and compliance framework for enterprises managing multiple risk areas at once. It supports teams that need strong data control and detailed oversight of how they conduct compliance operations across departments.

Source: ibm.com/products/openpages

The platform’s AI-driven analysis helps leaders identify issues early, align their compliance goals with business outcomes, and maintain transparency throughout the review cycle.

Many enterprises use OpenPages to connect regulatory data, automate assessments, and manage large-scale compliance programs that span multiple states and international regions.

It integrates easily with existing business systems, enabling continuous monitoring and reporting without disrupting daily operations. Its customization options make it suitable for organizations handling complex risk and audit requirements.

Key Features

Integrated risk and compliance – Unify audit, control, and policy data in one system.

AI-driven insights – Identify compliance gaps and potential risks automatically.

Custom dashboards – Visualize compliance status and progress in real time.

Automated workflows – Assign, review, and approve compliance tasks efficiently.

Flexible integrations – Connect with existing systems to reduce manual data entry.

5. CyberArrow GRC

CyberArrow GRC helps enterprises modernize their compliance and risk programs through automation and clear visibility.

Source: cyberarrow.io

It’s often used by organizations managing multiple frameworks or preparing for certifications like ISO 27001, SOC 2, or GDPR. Teams use its centralized dashboard to oversee compliance controls, track progress, and identify weaknesses before they become audit issues.

The platform focuses on helping compliance professionals save time and maintain accuracy during continuous reviews. Its automation capabilities simplify recurring assessments and routine updates, allowing teams to stay aligned with evolving regulations and internal policies.

CyberArrow GRC suits companies that want a structured, technology-first approach to managing compliance at scale.

Key Features

Centralized dashboard – View risk, policy, and control data in one place.

Automated reminders – Stay on schedule for audits and framework renewals.

Regulatory mapping – Connect frameworks and reduce duplication of controls.

Customizable workflows – Adapt review and approval steps to your organization’s process.

Real-time reporting – Generate compliance insights instantly for leadership teams.

6. Norm AI

Norm AI focuses on turning complex regulatory language into clear, actionable steps for compliance teams. It helps organizations interpret policies, assess risks, and align internal practices with global standards.

Source: norm.ai

Many enterprises use it to reduce manual review time and gain a better understanding of how changing regulations affect their operations.

Its AI copilots help compliance officers and legal teams automate policy mapping and documentation reviews. Norm AI also enables teams to compare internal procedures with new requirements, helping them identify compliance gaps quickly.

That makes it a practical choice for large organizations looking to maintain continuous compliance without heavy administrative effort.

Key Features

Policy interpretation engine – Translates legal text into practical guidance.

Compliance mapping – Aligns company policies with multiple global frameworks.

Automated document review – Detects outdated or non-compliant sections instantly.

Collaboration tools – Allow teams to comment, edit, and track compliance updates.

Regulation tracking – Monitors changes across major jurisdictions in real time.

Why Multi-Framework Compliance Requires More Than a GRC Workflow Tool

Enterprise compliance is rarely a single-framework problem. Most mid-to-large organizations manage SOC 2, ISO 27001, SOX, HIPAA, and NIST simultaneously with lean teams that have not grown proportionally with regulatory complexity. According to McKinsey, 62% of compliance functions have fewer than 20 FTEs managing an expanding surface area.

The platforms that solve this do not just organize evidence, they interpret it. Vero AI evaluates uploaded documentation against every active framework simultaneously, scores compliance at the requirement level, and flags gaps with specific remediation guidance. One evidence review. All frameworks covered.

This is what continuous audit readiness looks like at enterprise scale.

Related reading:

Automated Compliance Software: How AI Handles the Full Compliance Lifecycle

SOX Compliance Software: Automating Financial Control Testing

AI Audit Software: Architecture That Makes AI Findings Defensible

Making Compliance Management Smarter with Vero AI

Enterprise compliance no longer needs to feel complicated. With the right tools, organizations can stay ahead of audits, maintain clarity across frameworks, and free their teams from manual reviews.

Vero AI helps enterprises do exactly that. The platform combines structured automation with expert precision to simplify every stage of compliance management. From evidence collection to reporting, it gives compliance officers and business leaders the visibility they need to act faster and make informed decisions.

As a leading provider of modern compliance solutions, Vero AI supports organizations across industries with a secure, scalable system that adapts to evolving regulations. Its continuous updates, analytics, and multi-framework coverage make compliance more efficient and far less stressful.

Implementing enterprise compliance solutions isn't one-size-fits-all. Financial firms require robust automated auditing tools, while healthcare organizations prioritize HIPAA-compliant data storage and rigorous reporting capabilities to avoid heavy fines.

If you’re ready to simplify enterprise compliance and cut audit time in half, request a demo or get in touch with our team today.

FAQ

Table of Contents

Eric Sydell, PhD

Eric has two decades of experience in enterprise technology and was a founder of Modern Hire, which became part of Hirevue in 2023.